Multi-Account Management (МАМ)

Hey there, Protraders!

More and more investors use the services of professional asset management. Under asset management we understand the transfer of funds to the professional trader with the purpose of making a profit at the expense of performing the operations in the financial markets.

Asset management is one of the most effective ways to increase the capital. What is the appeal of the asset management? The licensed manager controls the funds. Large variety of managers and investment strategies gives a possibility to choose the option which best meet the requirements of the investor to the used assets, profitability, risks and terms of investment.

Transfer of funds to the management precedes the signing of the contract, which clearly identifies the rights and obligations of the manager and the investor. Attendant documents describe accurately and explicitly the management strategy, used financial assets, risks, predicted values of profitability, liquidity and terms of investment. Often, the manager goes to meet the investment preferences of the client that allows creating the unique financial products.

In the role of manager can be a bank, a private trader, a specialized fund, a division of the brokerage firm, etc. The manager is interested in making a profit, since his reward depends on the shown results. Usually, the reward of the manager consists of two parts:

- The management fee. This fee is charged at the beginning of the asset management term in the form of a fixed percentage from invested funds.

- The success fee or performance fee. This fee is charged at the end of the reporting management period. Usually is a pre-specified percentage of received profit.

Some managers, stressing their focus on result, don’t charge the management fee. In this case, their profit depends only on the trading results.

It is very important for the manager as well as for the investor to have a comfortable and functional tool that will provide the maximum convenience and transparency of the investment process. On the one hand, the manager should have a possibility to conveniently and efficiently implement his trading strategy on an unlimited number of trading accounts. On the other hand, the investor wants to keep abreast, by tracking the trading operations and dynamics of change in the balance of his trading account.

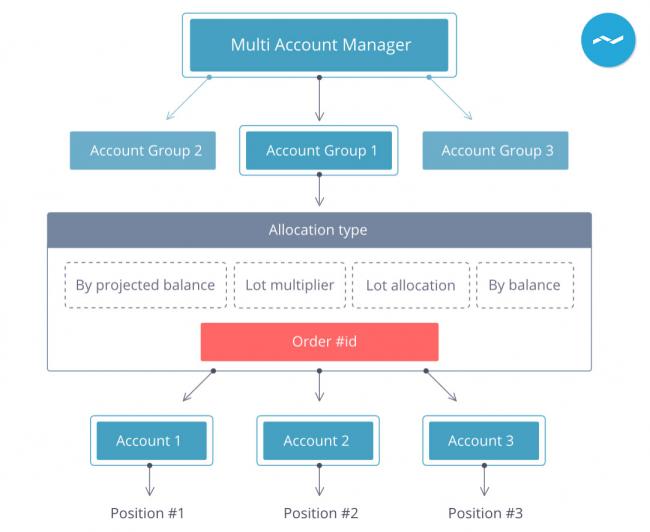

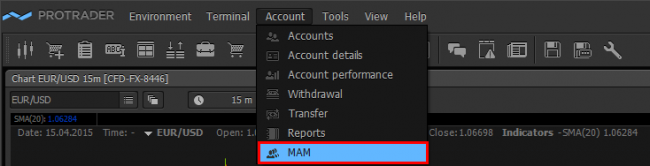

The structure of the “Protrader” trading terminal includes a separate system which manages a larger number of accounts - Multi-account Manager (MAM). MAM allows performing the trading operations centrally on a large number of trading accounts, while taking into account the personal investment conditions for each separate account.

Creating the groups of accounts

To work with investors funds using MAM, the manager should have the linked (attached) trading accounts of the clients. Attaching of the trading accounts is performed by means of the Backoffice terminal. MAM system gives a possibility to structure the available trading accounts in the groups. For example, is to use of the same trading strategy for several accounts simultaneously. The use of mass order is available for all trading accounts included in one group. Herewith, the allocation of the positions by all accounts of the group is performed instantly on a predetermined algorithm

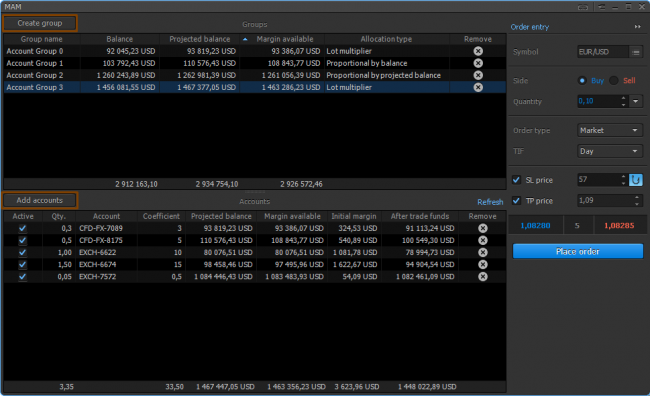

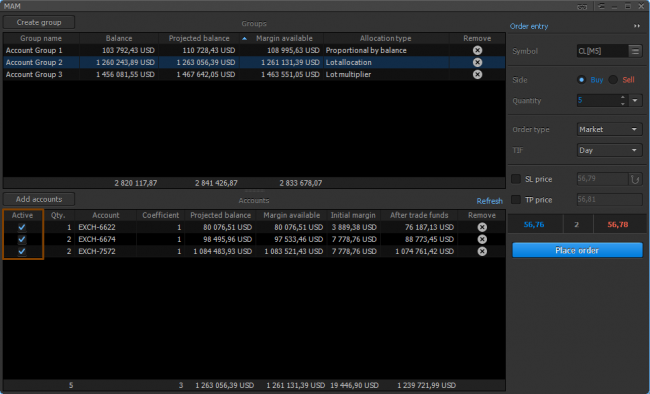

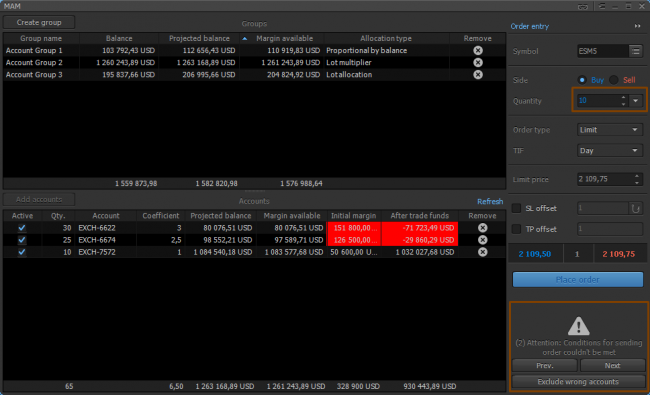

Let’s consider the process of creating a group of linked accounts and setting the allocation of lots inside the created group. To create a group of accounts, use “Create group” button located on the MAM panel. Created group of accounts is empty by default, in order to fill it, use “Add accounts” button.

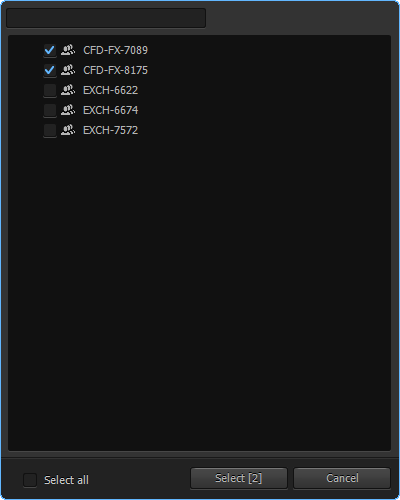

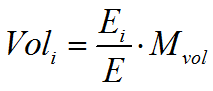

After clicking on “Add accounts” button, the menu that displays all linked accounts available for the manager will be opened. In this example, five accounts are available for the manager.

Select first two accounts and add them to the first group of the managed accounts. After that, MAM panel takes the following form:

Total characteristics and settings of the accounts’ groups are reflected at the top panel part. The characteristics and settings of separate accounts in each group – in the bottom part of the panel. Trading can be held on the whole selected group as well as by its separate accounts. Field “Active” is responsible for the selection of active accounts for the trading in the group.

Allocation of the positions between the accounts

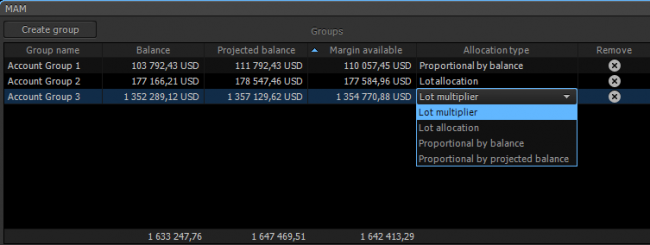

Depending on the management conditions and trading strategy, it will be convenient for the manager to use different algorithms of the positions allocation by the investor’s accounts in the group. Using “Allocation type” menu, we can choose one of the four options of the positions allocation by accounts of the group.

Options of the positions allocation in the accounts’ group:

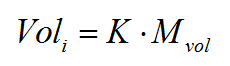

1. Lot multiplier:

where Voli – position quantity on the linked account,

K – allocation coefficient of the position quantity from the MAM panel,

Mvol – position quantity for group of the accounts specified by the manager.

2. Lot allocation:

where Loti – setting coefficient for the linked account,

Lots – the sum of all setting coefficients on the selected accounts,

Mvol – position quantity for group of the accounts specified by the manager.

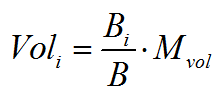

3. Proportional by balance:

where Bi – balance of each linked account in the group,

B – total balance of all linked accounts in the group.

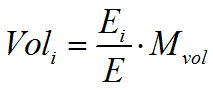

4. Proportional by projected balance:

where Ei – equity of each linked account in the group,

E – total equity of all linked accounts in the group.

If allocation options of the position quantity – “Lot multiplier” or “Lot allocation” were selected, then field for setting the coefficient value which is responsible for allocation of the position quantity for each account in the selected group becomes active in the bottom part of the MAM panel. Allocation coefficient of the position quantity can be less than unity that gives a possibility to work conveniently with groups, which include accounts that differ significantly from each other in terms of capitalization.

Fees, commissions and other payments

Large number of trading accounts and individual settings of fees, commissions and other payments require considerable operational time and manager’s attention. With the help of the “Protrader” terminal, the whole process of the periodic payments can be automated. Connecting a new account to the MAM system, it is enough for the manager once to set up account settings in the Backoffice, and all payments will occur automatically without taking a minute of time from the direct asset management.

Customizable parameters include the following:

- values of the payments (management fee, commission, performance fee and etc.);

- periodicity or individual payment plan;

- selection of the account for transfer of the payments;

- selection of the currency for payment.

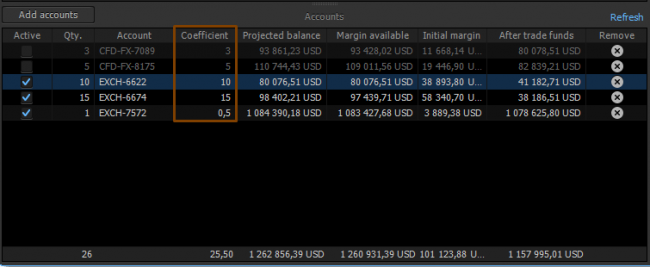

Trading in the MAM

Opening the positions in the MAM system is performed by the means of built-in panel for entering the orders. When creating a position using MAM panel, all the standard settings which are used in other panels and modules of the “Protrader” terminal are available for the user. Selection of the order types and TIFs, setting of the “Stop loss” and “Take profit” levels, and use of the algorithm “Trailing stop” is also available. Let’s use the mass order for the first trading group consisting of three accounts. Open the positions on the pair EUR/USD, herewith using the second algorithm of the position allocation (Lot allocation).

MAM panel reflects total characteristics of the account groups as well as individual accounts inside the group. This allows to the manager to track the dynamics of the trading accounts and make timely decisions on the opening, modifying and closing the positions. If the expected position for some reason cannot be opened, for example, due to the lack of margin funds, then manager will receive the notification and the corresponding indication of the problem account parameter.

In this example, the capitalization of one of the accounts is not enough to open the selected position. Herewith, the relevant characteristics of the accounts (initial margin and after trade funds) are highlighted in red.

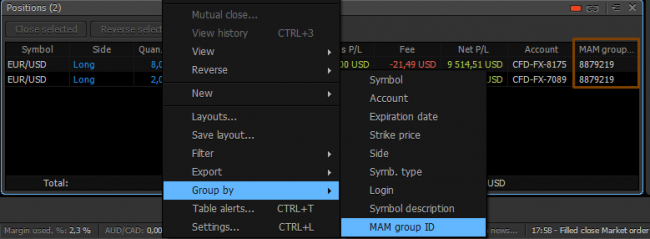

To track, modify or close the opened mass positions is comfortable from the corresponding “Protrader” panel. For the convenience of searching the position of individual trading group, we can group all the opened orders by a unique MAM group number (MAM group ID).

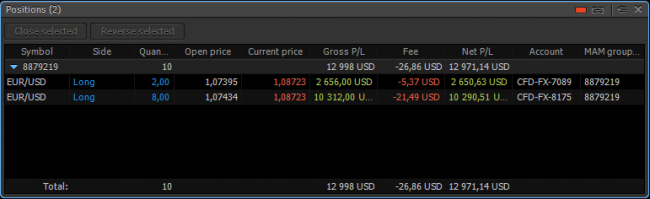

When opening the mass position from the MAM panel, a unique identifier of MAM group is assigned for each position, using which we can easily define the accessory of the position to a particular group of accounts and massively modify or close trades with one click. After grouping of the accounts by MAM ID, panel of the opened trades will take the following form:

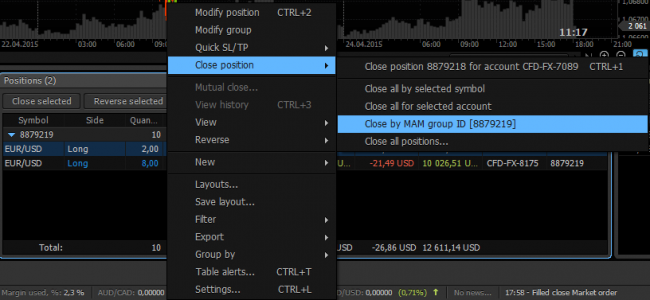

From this panel, using the context menu, it is easy to work with the positions belonging to a particular trading group. To close or modify all positions of the selected group, choose the appropriate option from the context menu:

Statistics

Statistics of all linked accounts is available to the manager in the “Protrader” terminal. At the same time, the investor also has an access to the statistics of his trading account. Thus, both the manager and the investor will have the opportunity to track the dynamics of the trading account in real time mode.

Considering the described functionality, it can be concluded that the system of managing a large number of trading accounts, implemented in the “Protrader” terminal, will become a good choice for managers, offering services of the asset management. The system of grouping the investor accounts, sending, modifying and closing the mass orders with one click, flexible adjustment of the position quantity allocation between accounts of the trading group, the ability to customize the system of reward payments and commissions – these are the tools of the successful manager.

Have not tried PTMC yet? There is no better way to boost knowledge than to use it! Start trading with PTMC now!