Simple Manual Trading System Part 2 - Optimization

This article is the second part in a series of lessons aimed at beginners who have an interest in creating their own strategy.

Enhancing your system

Hey there, Protraders!

Today we'll talk about developing our previous system a bit further. My last article was about signals and trend indicators - particularly Moving Average. If you remember, the first system consisted of two indicators - Moving Average and Pivot Points.

You can read the previous article here.

After using such a basic system for a while probably most traders will find it insufficient for their trading. There is nothing wrong with that, it's normal. Not every system fits not every trader. In fact, searching for system that will fit your character and personal needs is a long journey. Most probably you will have to try and evaluate many systems. One very important thing in such evaluation is to know the reasons for your failure. You must recall the whole decision process that resulted in your specific trade and then answer yourself few important questions:

Were you under stress? It's really important because very often personal issues may impact our trading decisions. There is nothing extraordinary with that, we're only humans, but a trader must always be aware of this fact.

Or maybe your attitude was perfect, but the market made something unpredictable? This happens pretty often. Was it system's fault or just a random effect of some surprising event like data reading?

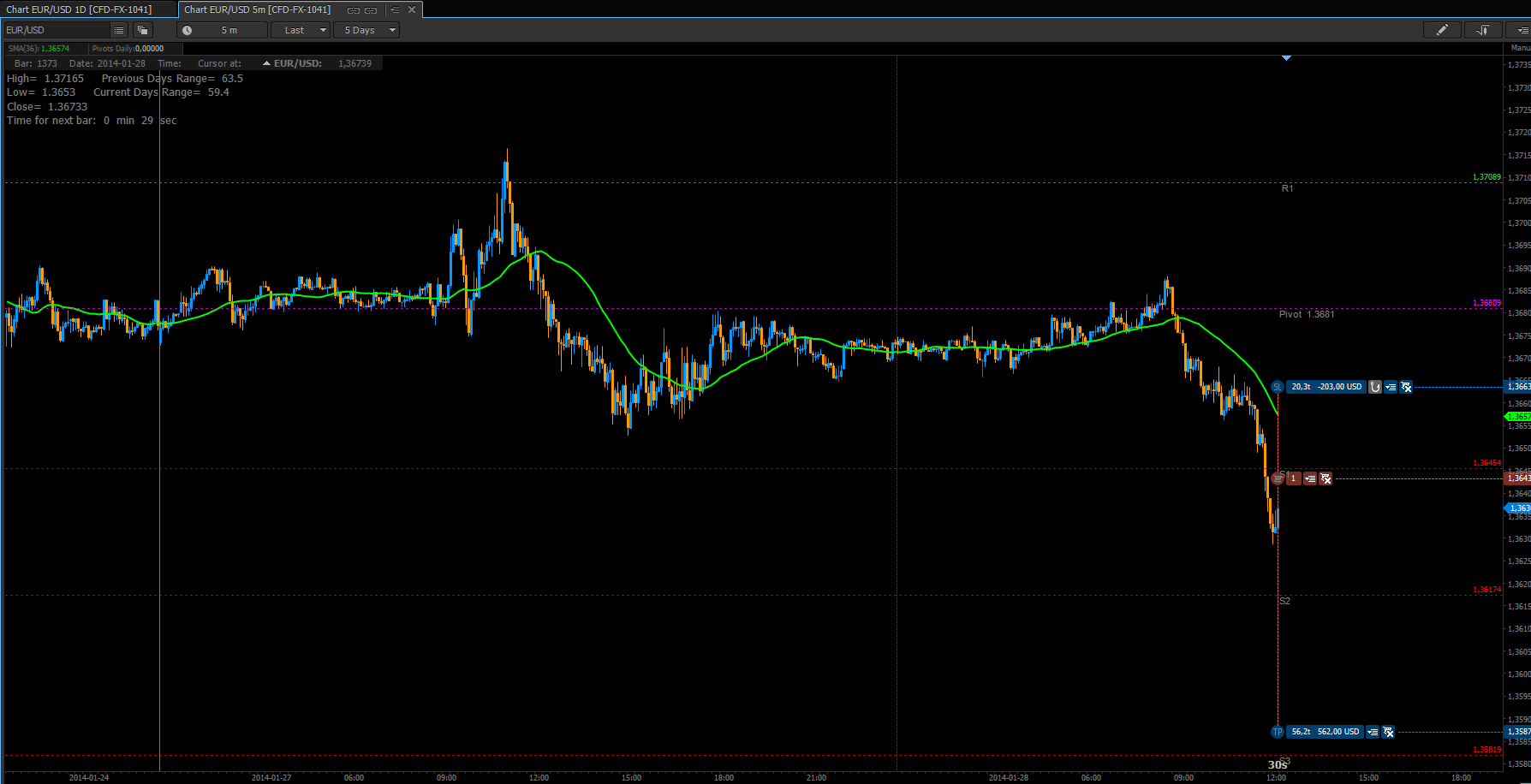

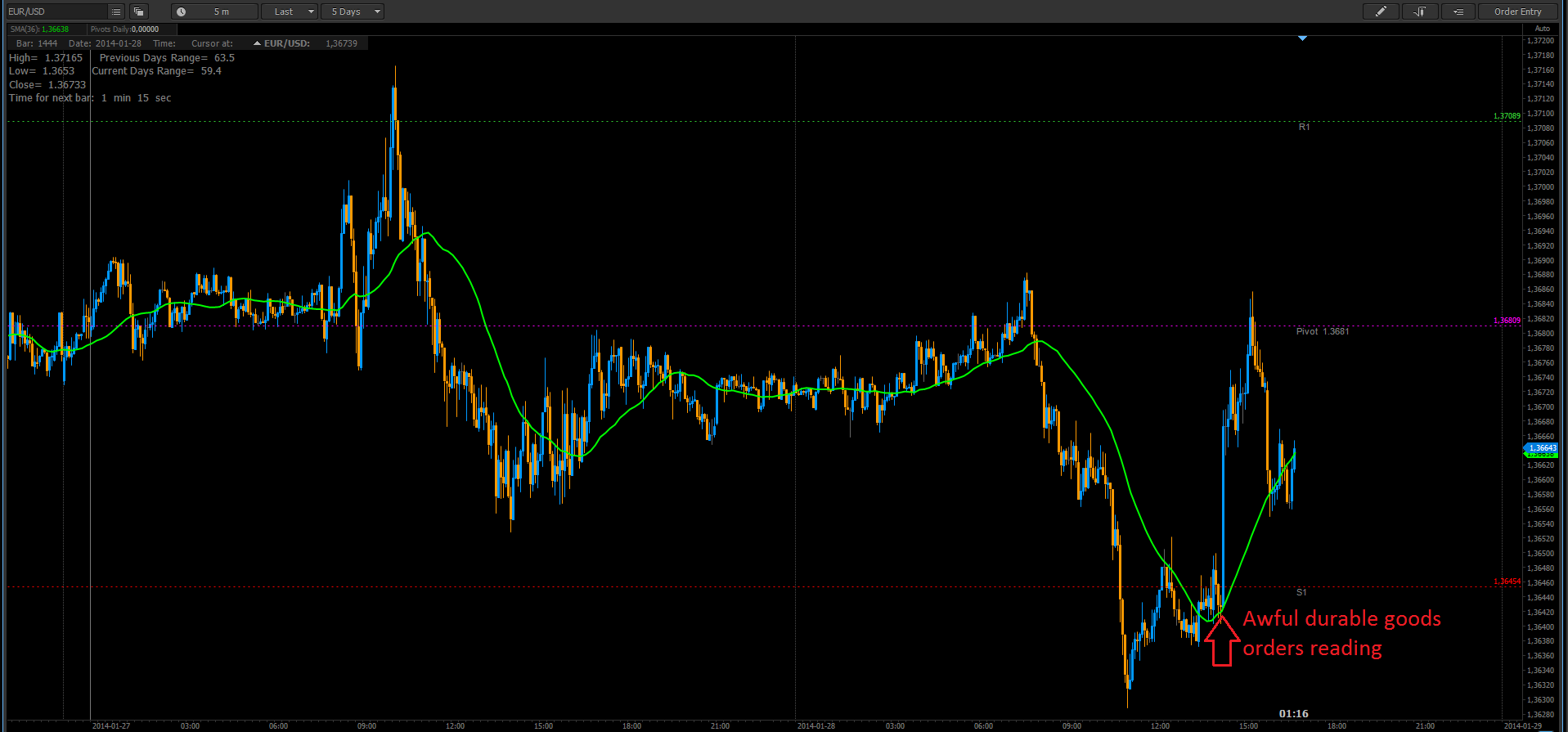

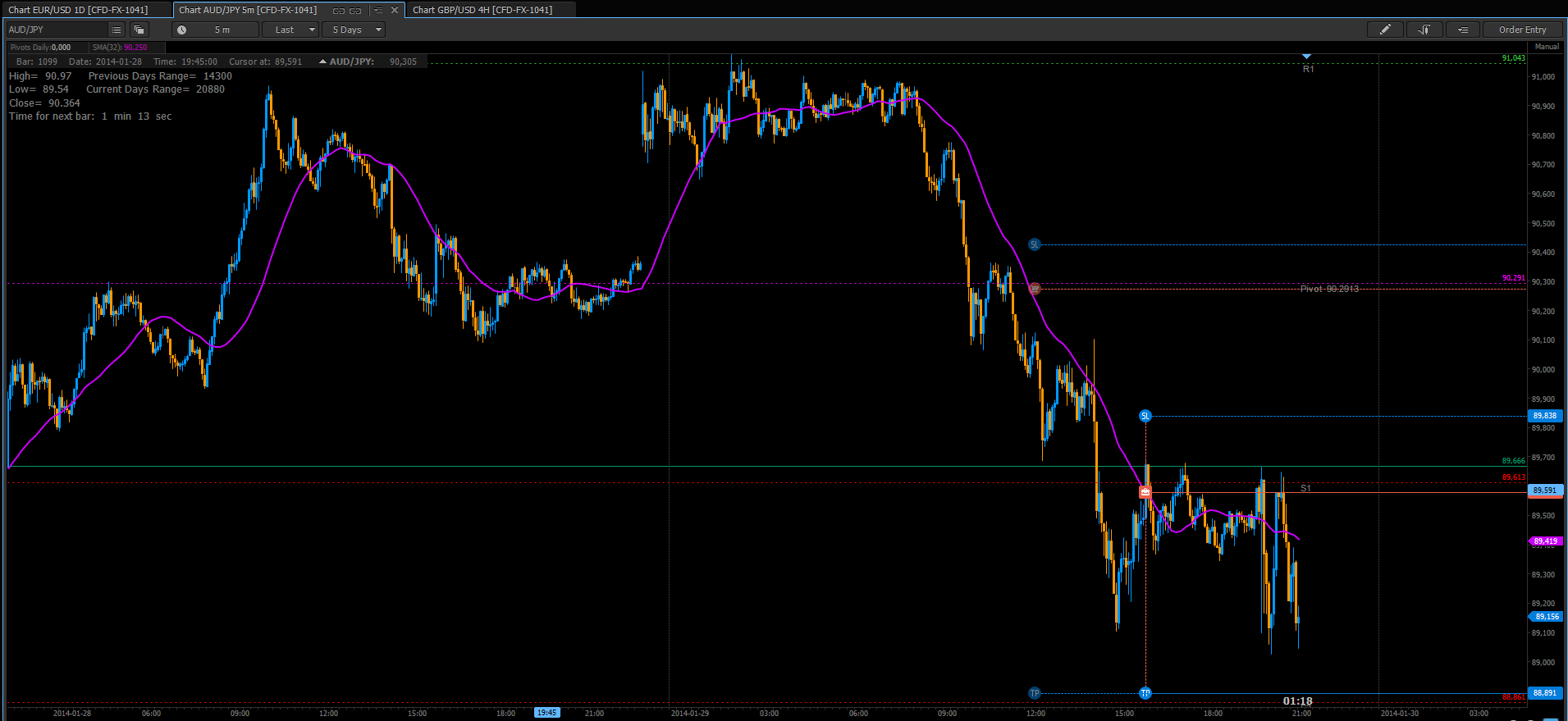

On the screen above we have pretty decent setup. Rapid break below yesterday's low and pivot resistance level. Moving average sliding as planned. So I've placed sell limit order right in a place where price were to meet moving average.

Everything was going well for most of the time but suddenly…

Price rushed upwards taking our Stop Loss. What was behind this extraordinary reversal was very bad data that came at this moment. There is also another reason - many traders say that EUR/USD pair is very difficult for technical trading. It would be incorrect to decide whether to use this system further or leave it just based on this one particular case.

Did you really follow your system? Or you were driven by greed or fear? Significant problem you may find on your way to profits is price running away from you. Don't try to reach too far. Such behavior will extend your risk, subtract from reward and make odds unfavorable. So, when you have your setup incoming, it's good to place limit/stop order upfront and forget about it for a while. This will save you some time on waiting and some frustration if you miss it. Remember: good intraday signals tend to last only a couple of minutes. Many traders, after missing their entry signal, try to catch a running train. It's very dangerous.

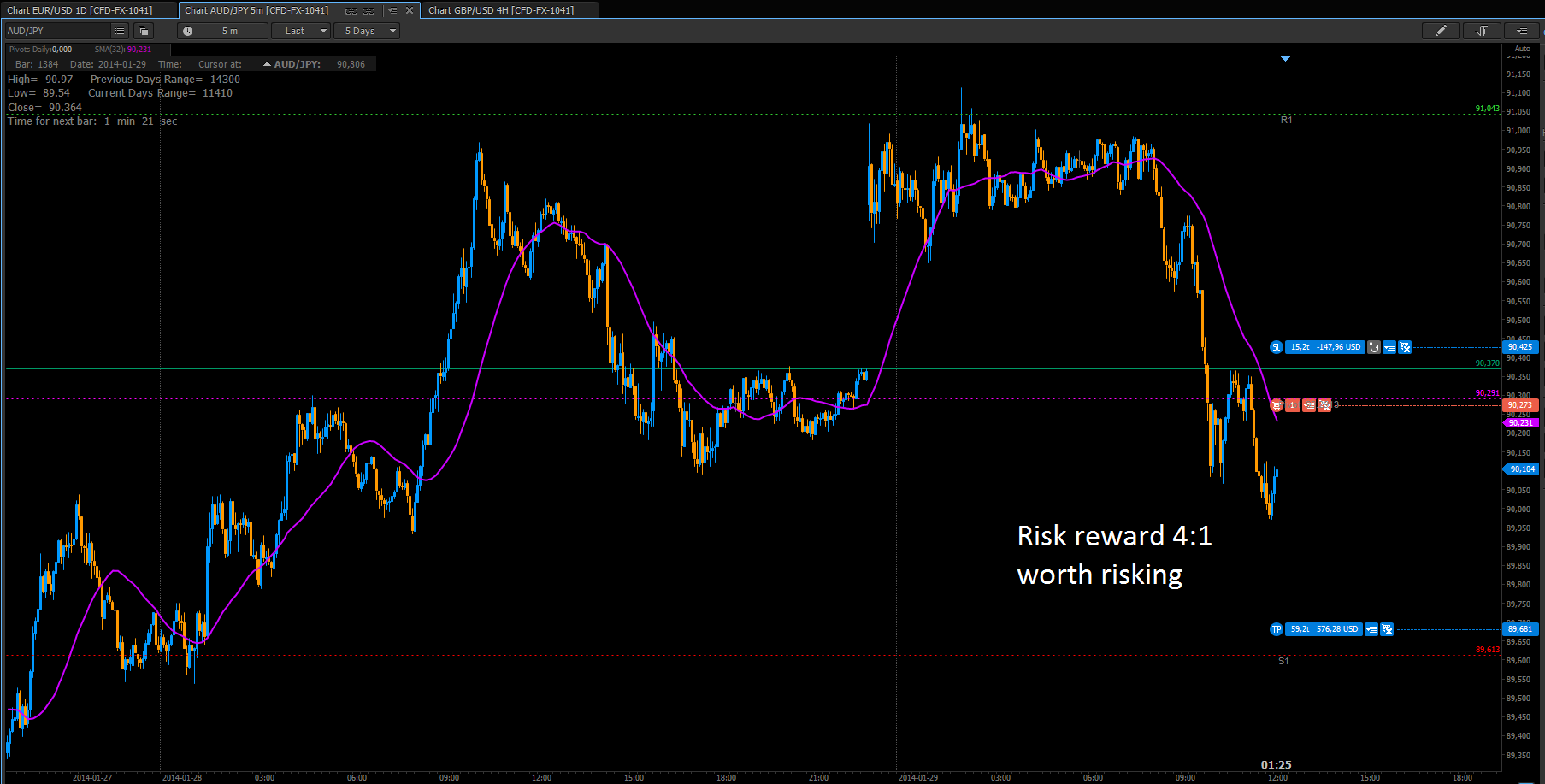

The above image shows good entry setup with decent Risk to Reward ratio. It's actually perfect opportunity but…

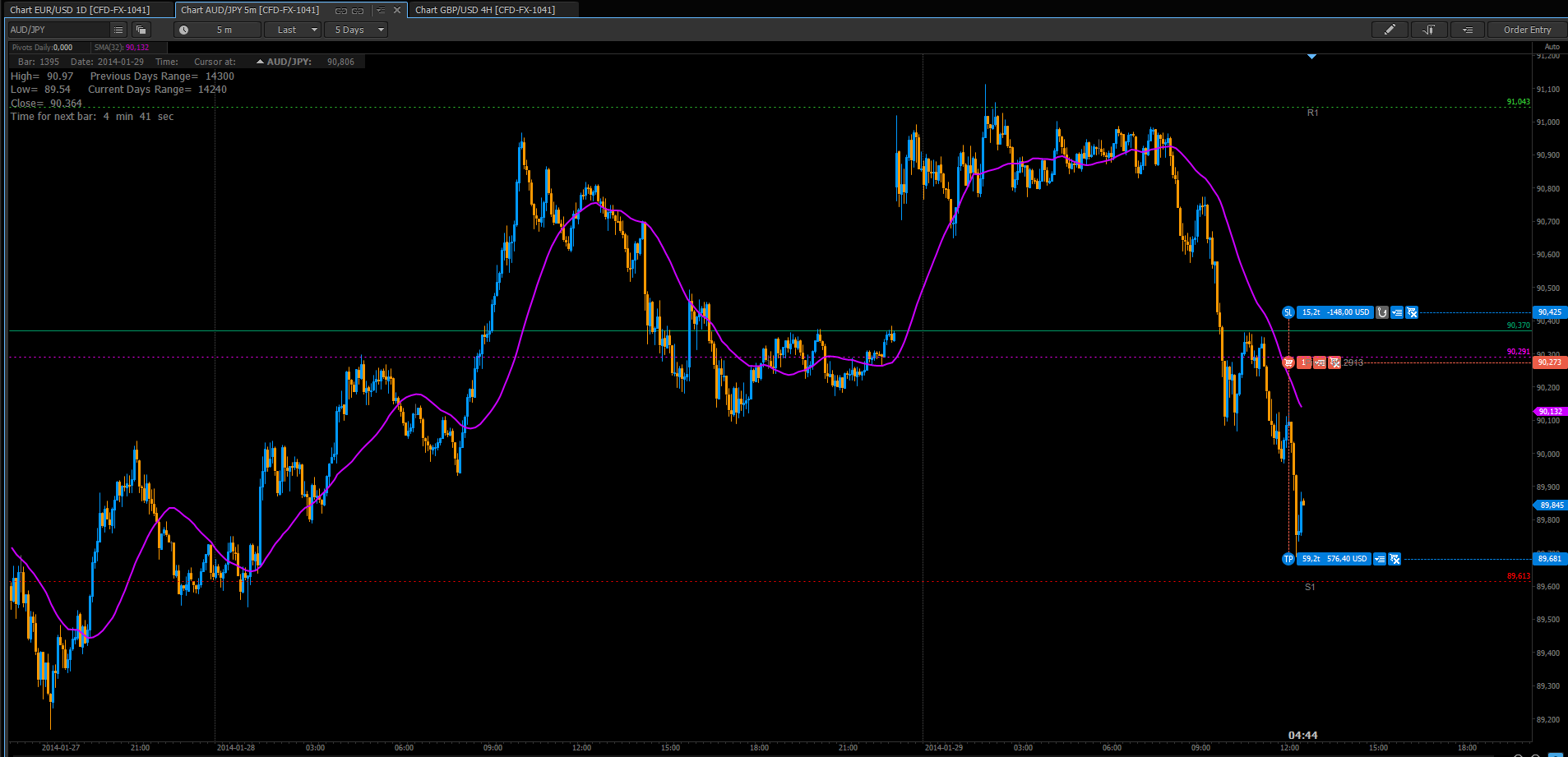

It wasn’t realized! Now take a look what would happened if you would want to attach to this fall whatever the cost. You would sell yesterday's support area without any advantage on the market and poor RR ratio. This time it ended as we anticipated, and AUD/JPY slid further to the first support (S1). In fact we've lost one opportunity, but we may receive another after support is broken. That would probably indicate another sell signal and we'd have confirmed that market is in very bearish mood. Soon the opportunity comes and we can try to exploit the selling pressure one more time with sell limit order.

Our order gets filled and price flies towards our Target Point.

But soon it's getting dangerous and price bounces from local support near our TP and local resistance near our SL level. This is an effect of Federal Open Market Committee statement.

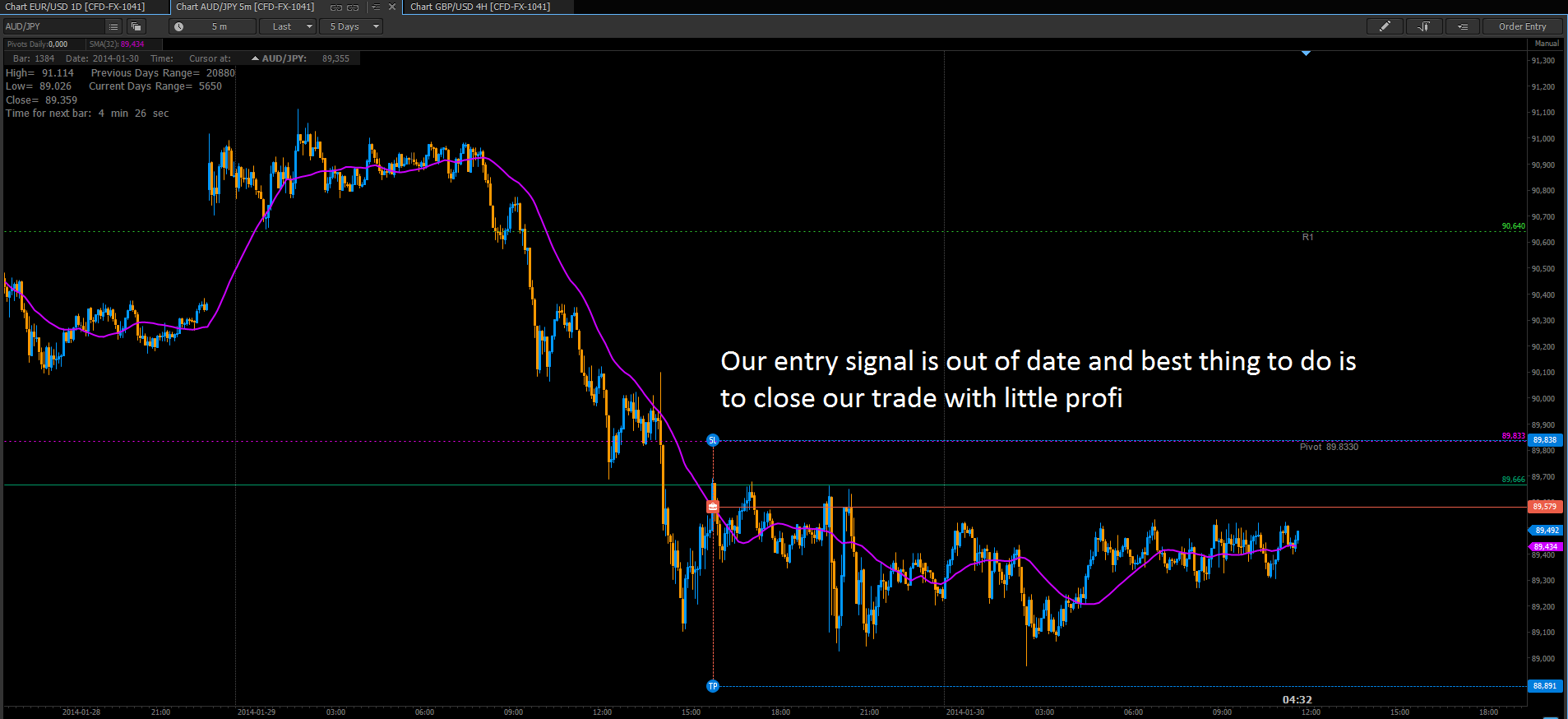

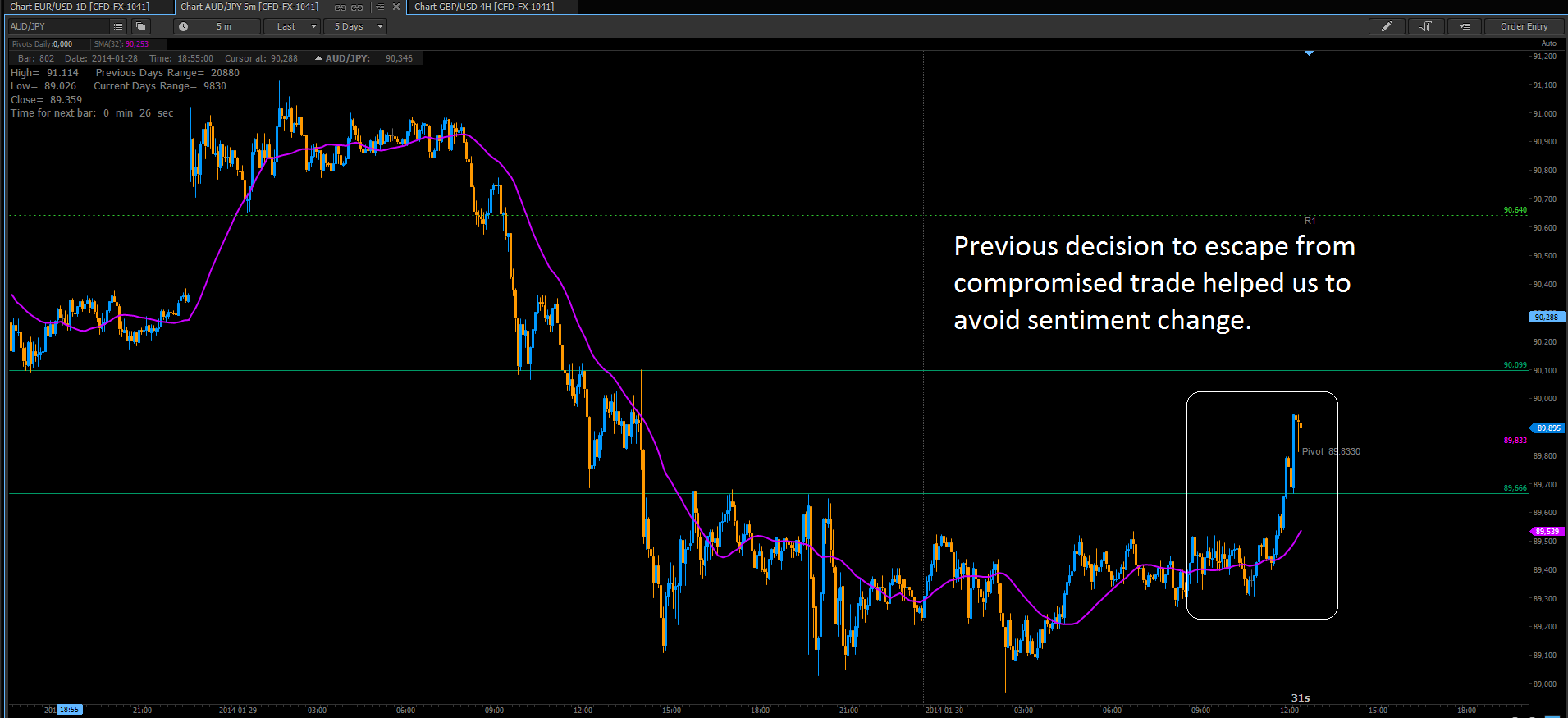

There price loses momentum and our trade seems to have run out of fuel.

Next day proves, that intraday market has lost its direction so we close our almost break even trade.

Saving few bucks though.

Are you trading the right market? Very common mistake traders often commit is trading on the wrong market. Technical indicators will be useless when price is driven by high impact fundamental events like central bank meetings, monetary rates adjustment, bond market crises, etc. In such cases no one on the market really looks for price patterns or order levels. They run as fast as they can to limit damage. In such cases it's better to stay away with your technical system. Another common mistake is to trade a range system in a trending market or a trend system in a ranging market. Such situation when you miss markets state with your trading will result in massive loses.

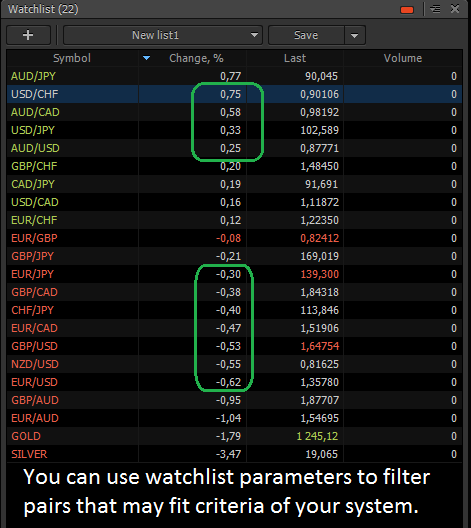

Hint: You can use watchlist filters to pick potentially playable pairs. For this system it's good that pair already made some significant move which has intensive orderflow. Therefore you can closely watch pairs that have pretty big change, i.e. higher than 0.25% and lower than 0.75 as in example below. Too low change reading may indicate, that pair hasn't got any certain direction. Too high reading may indicate that pair is oversold or overbought.

Are your expectations too high? Remember, it's not the system's fault that it does not catch every move. Actually no system can profit from every pip there is on the chart, and market, as a whole, is unpredictable most of the time. What your system needs is the ability to point out relatively safe trades with good potential to become profitable on a regular basis.

Is your enthusiasm just a “flash in the pan”? Many traders leave their system after experiencing consecutive set of lost trades. Every system will have lost trades and every system will have losing streaks. Simple statistics tells us, that 50% accuracy - and by the way that is an outstanding value in trading - may have streaks of 9 exact results. Would you make 10-th trade after 9 losers? Or maybe would you scratch such system after 4-th Stop Loss hit? And most traders actually do this. If you have 50% success rate in a longer run, then it's an excellent result (assuming real RR>1:1).

---

When you finally come to the conclusion that your system needs an enhancement, then you’ll have a few possibilities. You can optimize by adding another signal which main purpose will be to confirm or filter our basic setup in order to acquire higher accuracy of our entries. In my previous article I mentioned using Price Action for that. Interpreting price dynamics may be very useful if done properly. We could also add some new indicator or exchange one of old ones. I.e. for range systems Relative Strength Index or some kind of bands will do better job than just Moving Average. While adding new tools to your system you need to keep in mind that it's very easy to over optimize actual mechanism making it less effective or too complicated. Just as an experiment, insert 5 or 10 indicators on your chart and try to listen all of them making some good trades. Of course I mean Demo trades. Probably you will figure out soon that you are unable to trade this way consistently and in a disciplined manner. Also remember that most of indicators are derivatives of pure price. Therefore you won't acquire far different effects if you play with price in 5 or 10 different ways. It is trader who trades and earns money on the market, and not system itself. So the whole thing is focused on one problem: How much information of what kind are you able to process effectively while entering new trade? Best advised that this would be a time to pick your signals wisely and rely rather on their quality than on an actual number.

The other dimension on which you may need to optimize your system are Stop Loss and Take Profit values. SL is like the speed limit in your town. It will slow you down but decrease the chances of you getting into a fatal accident. Therefore you should always remember to use seatbelts and obey the speed limit while driving your account. A trading system may perform really well. It might have outstanding effectiveness or gather lots of pips per trade, but then one bad day can come and most probably will come and you have to be prepared for that. In my next article I will try to cover this subject of system development.

Have not tried PTMC yet? There is no better way to boost knowledge than to use it! Start trading with PTMC now!