Elliott wave principle. Random coincidence or an effective technical analysis tool

Hey there, Protraders!

This article is more informative, rather than a practical guide of the wave analysis. Elliott theory arouses a huge interest among traders due to the ambiguity of its interpretation in any given situation that often depends on the opinions subjectivity.

We would like to introduce you the history of the Elliott wave theory, as well as to show its connection with the Fibonacci numbers. Herewith, not to make a stereotyped description of this tool, but look at this all from the perspective of the traders' and financial analysts' experience, both of the current time and the past, i.e.:

- those, who can be considered as “disciples” (followers) of the Elliott, who actively used the wave analysis to predict the market movements;

- those, who held radically opposite view and were supporters of its incapacity and the ambiguity in the interpretation. All of them have taken a worthy place in the history of formation and development of the financial markets.

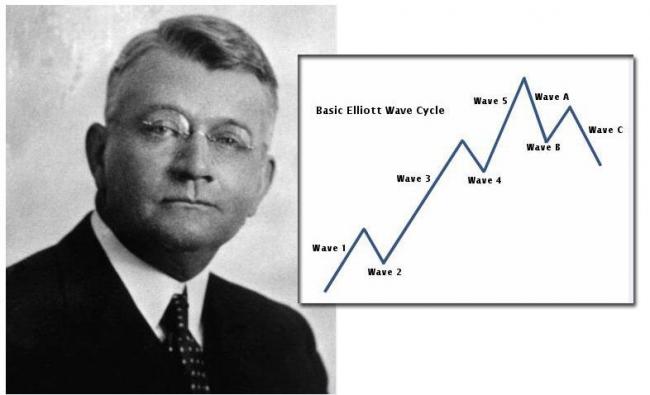

The founder of the wave principle – Ralph Nelson Elliott

The wave principle can be rightly considered one of the most interesting sections of the technical analysis. Its creator – Ralph Nelson Elliott (1871 – 1948) was born in the Kansas, US. He built a successful career as an accountant that gave him the opportunity to make an individual contribution in the improvement of accounting for railway companies in Central America.

20s-30s of the XX century were marked by a period of development of the theory and practice in the direction of exchange trading. This coincided with the formation of scientific approach to the market analysis and creation of many theories for the search of patterns in its behavior.

At the same time, Elliott starts learning the stock market with particular emphasis on the pricing models by studying charts of stock indices.

Understanding that the wave structure inherent to the market makes it possible to determine the targets of price movement and make very accurate predictions.

“The Wave Principle”, “Nature’s Law — The Secret of the Universe”

Elliott book “The wave principle” was published in 1938. In the book, the author recounted all his achievements in the wave analysis, as well as its interaction with various technical tools.

The last and most important work, according to the author, the world saw in 1946. It includes all the theoretical and practical knowledge of the wave analysis. The book “Nature’s Law — The Secret of the Universe” can be rightly considered as his greatest achievement. He presents it as part of the universal nature’s law, affecting all spheres of life. In the book, he describes the principles for the development of human society, the laws and rules of origin of all the processes monitored in nature and environment. Elliott closely connects the wave principle with elements of the Fibonacci sequence.

The theory of wave analysis

According to the wave theory, the movements, which the price describes on the chart, can be structured. Many traders actively use it for analysis of the market behavior in the past, and for prediction of its movement in the future.

According to Elliott, the wave principle was based on:

- Charles Dow’s theory, which described the behavior of prices on stocks with the passage of time;

- Classic pricing models – figures of technical analysis (double top (bottom), head & shoulders, triangle, flag, pennant and others.

All of them fit perfectly in "The Wave Principle" and are amenable to interpretation and explanation.

During his investigation of natural processes and price formation on the stock exchange, Elliott had developed and described 13 wave models, which tend to repetition on price charts due to their structure and form. Their main differences are:

- time index;

- the amplitude of the movement.

Based on this, the author had developed a number of rules, allowing to analyze the behavior of the market, assess its condition in a given situation, as well as to predict its development in the future.

Elliott allocated 8 cyclically repeating waves. Five of them by the trend (basic movement) and three correctional. As we all know, there is no such directional movement in the financial markets, which will not be followed by a backlash. The price on the financial markets can move in an upward or downward trend, as well as to be in the so-called "Flat" (the price does not have unidirectional structure).

Wave principle has the following concepts:

- There is no unidirectional movement in the financial markets, which will not be followed by a backlash.

- The basic movement is composed of 5 waves, a correctional – of 3.

- 8 waves – is a full cycle at a certain timeframe.

- The full cycle on one time interval – (5-3), these are two high-order waves, i.e. the market movement has a fractality.

- The basic eight-wave model is unchanged.

Interaction with Fibonacci tools

In the words of Elliott, the mathematical foundation taken as the basis of his wave theory was numerical Fibonacci sequence, in which each successive number we get by adding the previous two (1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233 ...... and so on to infinity).

If we pay attention to the Fibonacci sequence, we can notice that it displays the exact number of waves on each detailed level of Elliott models (3 – correctional movement, 5 – basic movement, 3 + 5 = 8 – a full wave cycle). This interaction between “waves” and “numbers” is very interesting, since it connects the wave principle underlying the stock market with models and processes, which surround us in everyday life (DNA, structure of the human body, plants, animals, and natural phenomena).

Fibonacci tools in conjunction with the wave theory play an important role in the analysis and prediction of the price movement. The most well-known and easy to use are: retracement, expansion and Fibonacci channel.

The most important retracements are: 38.2, 50, 61.8. More information about the Fibonacci tools you can find in our previous article – Fibonacci made easy.

The followers and critics of "Elliott wave principle"

Regarding the Elliott wave analysis the views of traders, analysts, investors have divided in rather equal ratio. Half of them blindly believes and follows this theory, considering it an all-powerful, and do not try to cast doubt on its effectiveness. The other half on 100% denies the possibility of its practical application for the analysis of the financial markets and price prediction.

None of those, whom Elliott taught personally, has continued the work of the teacher in the investigation and improvement directly of the wave analysis. However, created by him theory later contributed to the emergence of many great personalities of experts on the financial markets analysis. They were Hamilton Bolton, Edson Gould, and Robert Prechter.

Hamilton Bolton – is one of those, whose predictions differ by its special accuracy and practically always came true. He was one of the first who began to popularize the theory of Elliott. Though he was a supporter of the fact that having waves is not enough to succeed in the market, it is necessary to have your own trading system.

Edson Gould can truly be considered a guru in forecasting the stock market of 70s. He was the author of the "three steps" theory, in the base of which he used Elliott wave principle. Gould believed that after three upward movements necessarily will be the fall. He ideally predicted the fall of Dow Jones below 500 in 1974. Later in 1976, inflation gripped the United States and its analysis methods have become ineffective.

Robert Prechter – well-known as the author of the bestseller "Elliott wave principle: Key to market behavior". He also became famous for its accurate forecasts, which were based on the knowledge of the Elliott wave theory. Prechter was a supporter of the hypothesis that all areas, which surround us, including financial, directly subordinated to the mood prevailing in the society.

The opponents of the wave theory can also list a lot of weighty arguments and counter-arguments:

- all the movements in the market cannot be displayed in some dozens of models;

- permanent change of psychology behavior of the market participants;

- difficulties in defining the entry and exit points;

- absence of time limit during the formation of a wave and its subsequent movement;

- subjectivity of the analysis;

- impossibility of practical use on small time intervals.

The most famous skeptics of the wave theory are:

Benoit Mandelbrot – the famous mathematician, well-known as the creator of the fractals theory, he called Elliott wave theory and market forecasting based on it – an art. He believed that the results obtained owing to this analysis are subjective and depend on each person individually, as well as the personal vision and perception. In his opinion, are too few precise mathematical calculations in the theory of waves.

Warren Buffett – one of the richest men on the planet, as well as one of the most successful and stable stock market investors. He is skeptical to all the technical analysis tools, but all investment decisions regarding the purchase or sale of shares, he made solely based on fundamental indices. Both followers and opponents of the wave theory often cannot convincingly justify their choice of one or another point of view. Everything depends on the individual views, experience and approaches of each.

What we have?

The use of wave analysis has left a bright trace in the history of movements’ prediction on the stock market in the XX century, owing to its accuracy and reliability. However, this technique is not perfect, and to be limited exclusively by its scope when working in the market may be not expediently.

Elliott had successfully developed and applied interrelated principles, owing to which he described known to him movements in the market up to the 1940s. When DOW JONES index was within one hundred (100) points, the author predicted the start of the upward trend on the coming decades. Whereas, all other analysts and financial advisors did not even allow the thought that the index will rise. Many of them did not believe that the peak in 1929 would be exceeded.

It is not always the wave analysis can exactly predict subsequent price movements in the market. Therefore, when the situation on the chart is not clear or there is any doubt, use other analysis tools. I would like also to draw attention to the fact that the wave analysis is based on historical data and on the tries to interpret them in real time. Much better to use this tool in conjunction with other technical analysis mechanisms.

And which ТА tools are you using?

Do you use tools same technical analysis tools in your trading? Fibonacci, Elliott tools

Are you a supporter of the Elliott Wave principle?

Have not tried PTMC yet? There is no better way to boost knowledge than to use it! Start trading with PTMC now!