Low-risk strategy for collecting the dividends using the Options

Hey there, Protraders!

There are many companies on the market, which pay dividends on a quarterly basis to the holders of its shares. This possibility can be used for receiving an additional profit to its own deposit. Let’s consider the main moments of the dividends payment.

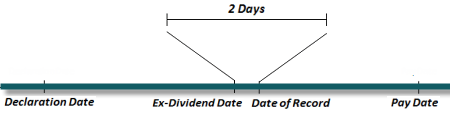

There are four key dates, which are used in the process of receiving the dividends:

Declaration date – is the date on which the Board of Directors of the issuing corporation states that dividends will be paid. The declaration also contains the amount of accrued dividends and the date of payments.

Ex-Dividend date – is a specific date before which the investor must have the corresponding shares in the portfolio to qualify for a dividend. Shares purchased directly in this day or later do not participate in the calculation of dividends.

Date of record – is the day when the issuing company finally approves the list of shareholders eligible for receiving the dividends. This usually occurs within 2 business days after the ex-dividend date.

Pay date – is the date when shareholders receive the dividends on their accounts.

The investor is eligible to receive the dividends, if the company’s shares are in his portfolio at the time of the ex-dividend date occurrence. Herewith it is not necessary to be a shareowner for a long time, after ex-dividend date a shareowner can sell the shares and receive the dividends at the pay date. Based on such rule, many traders have tried to buy shares just before the ex-dividend date in order to collect dividends and then immediately to get rid of these shares. However, such a moment has long ago been considered by market and, as a rule, on the day after the ex-dividend date, the market opens with a decrease that is equal to at least the amount of dividends, nullifying the profit from such manipulation. Naturally, the fall in the price of shares on the next day happens not in 100% of cases, since other fundamental and technical factors may affect the asset, but it is necessary to consider this pattern.

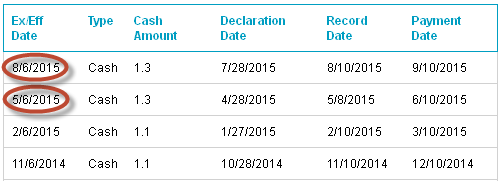

Let’s consider several typical examples. Last ex-dividend dates are specified in the dividend payment calendar of the IBM company.

The day after these dates, the market reacted in the form of typical price decrease, completely covering the potential benefits from receiving the dividends, and this behavior is not unusual for such a case. Similar situation for the last few dates of the current year (February 6th, May 6th, and August 6th) are shown on the chart below.

However, there are methods allowing to receive dividends by the share and not to depend on changes in the asset price. Such strategies involve the purchase of shares using option hedging of the position.

One of the methods is to open a long position by the shares before the ex-dividend date with the hedging of its Put option in the money. After accrual of the dividends, the trader simply waits for the expiration of its Put options, and closes the entire position, without the risk of losing money on the decrease.

To illustrate this strategy, let’s consider a hypothetical example. For example, some share of ABC is trading at $90, herewith approaches the time of dividends accrual, and, according to the plan, the company is going to accrue to the holders of $2 per share as dividends. Herewith, Put option in the money with strike price of $100 on this share is sold at $1100. To qualify for a dividend, the trader buys 100 shares for $9000 and Put option for $1100, paying $10100 for all. After accrual of dividends at the amount of $200, the trader waits till expiration and executes Put option by selling its 100 shares at the price $100, and receives $10,000 to the account. Therefore, the trader invested $10,100 in the position, and took $10,200, thereby earning $100, not depending on the asset price.

Buying shares without applying the hedging, the investor is exposed to a significant drop in the share price. With adding of a Put option in the money in the position, appears an insurance against significant price reduction.

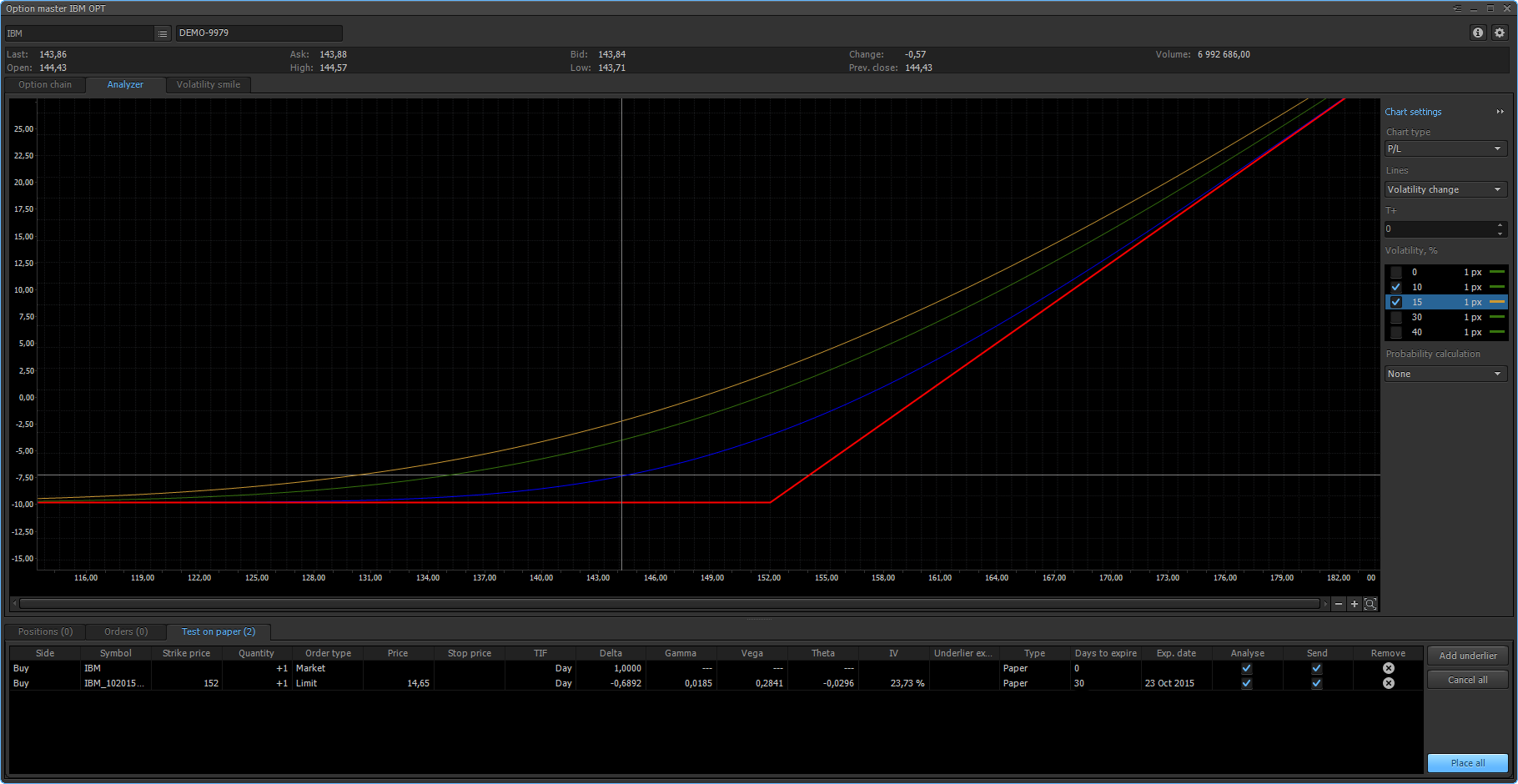

Let’s consider the risk-profile of similar position for a better understanding.

In this example, 100 IBM shares at the current price $143.86 and Put option with a strike price $152 were bought. From the profile of the position, it is seen that any reduction in prices will not bring additional losses to the trader, at the same time, possible growth in the prices above the strike level $152 promises an additional profit. If for some reason, the market goes up above the strike price, and the option expires out of the money, the trader will close a long position by the shares, herewith receiving profit from the growth of the asset. This position is a synthetic Long Call option, which has the characteristics of an option with the ability to receive dividends.

Peculiarities of using the strategy

Before using this strategy in practice, it is necessary to consider a few moments. First, for plotting such a position you will need to buy one or several lots of shares, and for that, accordingly, you need a sufficient amount of the deposit to maintain the margin requirements. Second, when implementing such a scenario, you will receive a relatively small gain on the invested capital in each trade. A good point is the fact that the profit you receive by investing in the asset over a relatively short period of time – about 10 days, and herewith staying in a well-protected position.

To use this strategy, first the trader should select the shares on which the companies pay out the dividends, and for which the ex-dividend date is approached. After that, it is necessary to hold an analysis of each from these shares on the opportunity to receive a profit. There are several online resources allowing trader to track shares with approaching ex-dividend dates, which give additional analytical information. For example, you can use the calendar of dividends from 'TheStreet.com' as a starting point for the selection and analysis of potential candidates for a deal.

After finding the shares with approaching terms of dividends accrual, the next step will be to consider the possibility to apply the strategy of collecting dividends to them. It is necessary to check whether a particular share has actively traded options desk or not, and is there a possibility to buy Put options with strikes in the money. If a share does not have active options market, we skip it, since it is not suitable for use in this strategy. As practice shows, in order to reach the necessary options liquidity, it makes sense to open a position a week before the ex-dividend date, selecting the short term till expiration, usually, not more than 10 days after the date of dividends' accrual.

Regarding the choice of the correct strike for Put option, it is necessary to search it in the range of 5 to 15% higher than the current price of the asset. Let’s look, for which strikes in this range there are liquid options, and then for each one – the cost of option position. If the size of the expected dividends is above the intrinsic value of the option considering the commissions, then we examine a Put option with this strike, as a candidate for the opening. Such operation we hold for the whole list of selected shares and choose the variants with the greatest potential of the profit. This is the main analytical work when using this strategy.

Choosing the most profitable variants, the trader can start implementing the strategy. It is necessary to open a long position by selected shares and corresponding number of Put options simultaneously. After that, you should hold this position till ex-dividend date ending, and then simply wait for expiration of the options and, executing them, close the position by shares. More experienced traders can also consider the early closure of the position, without waiting for the expiry of the option. If the liquidity of the options allows, and total profit of the position is at the desired level, we can simultaneously sell shares and Put options, thus receiving the profit faster. Such situations are possible in the cases of asset price growth above the strike price, and if you want to capitalize on the time value of the options, without waiting for its decay.

What kind of risks are waiting for traders when working with this strategy?

The good news for traders is that the risks of using this strategy is extremely small. Firstly, there is the risk of error in the calculation on the analysis phase until making a trade. Here we must be attentive to detail and double-check the initial data: the amount of dividends, operating costs, the cost of the option position, strike price, expiration date of the options and other.

The second and perhaps the most significant risk is the possibility of slippage when opening a position. In order to get the expected profit, it is necessary to ensure the simultaneous opening of trades on the shares and options by the planned prices. The risk of slippage is also possible in the case of early closure of the position. Usage of only highly liquid shares and their options, as well as the application of limit combo-orders will help to solve this problem.

Having acquired some experience in such trades, the traders with sufficient capital will be able to get systematically the additional profit to their deposits without unnecessary risk.

Have not tried PTMC yet? There is no better way to boost knowledge than to use it! Start trading with PTMC now!