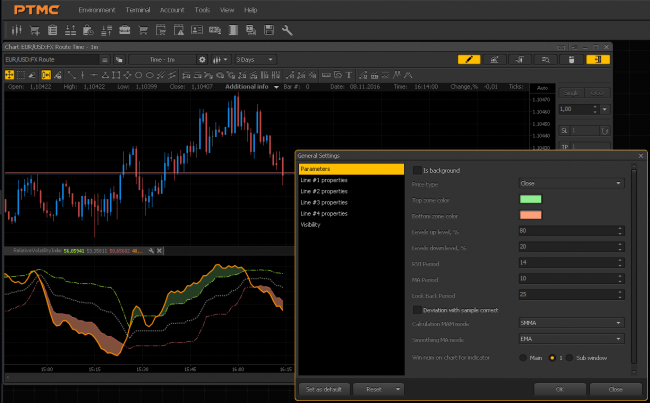

Relative Volatility Index indicator

The Relative Volatility Index(RVI) was created to define the direction of volatility movements. It measures market strength and used as a filter to confirm the independent indicators values. It doesn't show the price movement.

On first sight, RVI looks like relative strength index (RSI), with the difference that the first one uses the standard deviation of daily price changes instead of absolute price changes.

The advantage of RVI is the ability to get necessary diversification impact which absents in the Relative Strength Index trading system.

RVI - this is not a separate component, it is used to confirm incoming signals and trading systems improvements. Good Luck!

Files

09.11.2016

09.11.2016

68

68

Discussion

Join PTMC community to post your comments

No comments yet. Be the first.